Unlike standard spot trading exchanges, Bitcoin options exchanges tend to suffer from low daily trade volume and poor liquidity. Any call options with an exercise price strike price above 12, dollar would expire worthless. Fixed USD and Volatility orders can be changed by pricing engine maximum once every 6 seconds, because Deribit index updates every 6 seconds. Please note that at this moment we cannot accept new market makers others than those with whom we are communicating and are already preparing to connect. On Deribit this will happen automatically. Thankfully, there are a number of simple indicators that can be used to better determine whether a platform is trustworthy or not.

Top articles

It is about buying Bitcoin Options. Buying Options is a limited risk trade. Deribit has no Options Calculator on its platform. Part 2 will treat the subject of selling options, also known as writing options, which is much riskier than buying them and carries unlimited risk. It will also take a look at Options strategies, and delve into the Greeks. One entire side of the market is off-limits to mex clients and the absence of competition on the writing side means Bitcoin Options at BitMEX are over-priced and the mex market maker is receiving economic rent from users.

Top articles

For years, Bitcoin option trading was not regulated in the U. They are extremely volatile and very expensive. Take a look at the below pricing screen for June 7, As IV rises, so does the price of an option. So how expensive is this?

It is about buying Bitcoin Options. Buying Options is a limited risk trade. Deribit has no Options Calculator on its platform. Part 2 will treat the subject of selling options, also known as writing options, which is much riskier than buying them and carries unlimited risk.

It will also take a look at Options strategies, and delve into the Greeks. One entire side of the market is off-limits to mex clients and the absence of competition on the writing side means Bitcoin Options at BitMEX are over-priced and the mex market maker is receiving economic rent from users.

And another minus: their Put Options are knockout barrier options; there is a limit placed on the potential profit of the buyer of the DOWN options and on the potential losses of the writer BitMEX anchor. The Bitcoin Options how to buy call options on bitcoin Deribit are Traded European Options, meaning they can be traded at any time during their lifetime but howw can only be exercised at expiry.

American options can be exercised at any moment during their lifetime. There is a widely-held misconception that this means you can only sell your Deribit Options at expiry. This is wrong, you can sell them whenever you like. Expiration days byy on Fridays, UTC. Weekly, monthly, quarterly 3 monthsand 6 month options are available. The longer-dated the option the more time value you pay for and buh more expensive the option.

At time of writing these Expiries are available:. The more ITM the option the greater the premium. Bitcoin Options will be cheaper, other things being equal, when the Bitcoin market is calm low how to buy call options on bitcoin and more expensive with greater volatility. There are three places to check volatility:. We need to distinguish historical or realized volatility from the Implied Volatility that is implied by Options prices.

Remember this from December ? Buying options is much less risky than writing Options. The risk to the buyer is limited to the premium they pay on bitciin the trade. The risk to the Writer is unlimited, and may greatly exceed their initial margin if the price moves adversely against.

On the Deribit platform you have to be careful not to go Net Short in any option. Only sell Options in which you have already bought a position.

Be careful with that Sell button! As an example, consider those Dec18 Puts I bought for 0. You can mitigate this by choosing to trade those options with the greatest liquidity.

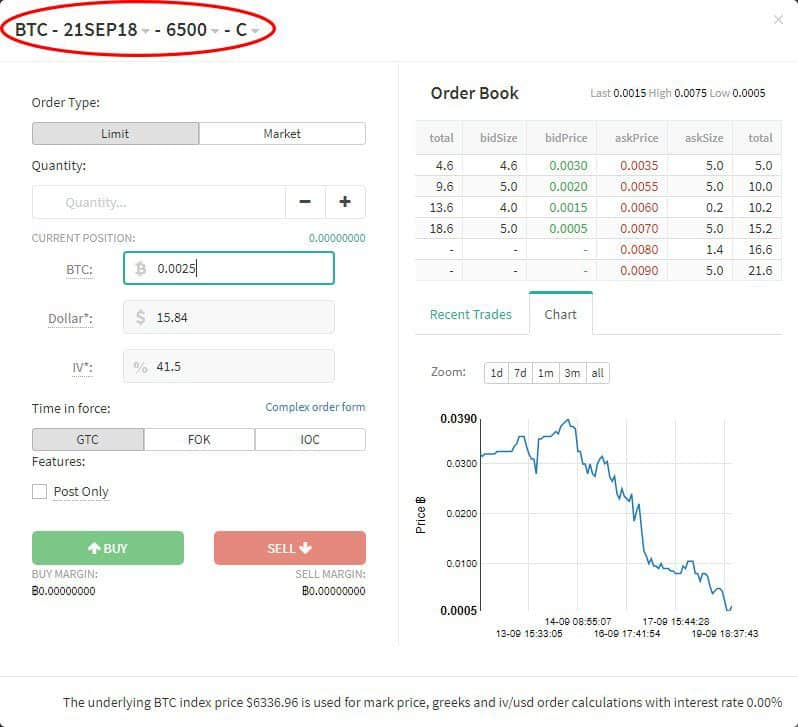

So if we are interested in Puts on the 28Dec18 expiry then avoid the Strike. Call Strike has much better liquidity by both measures. If we drill down to the Strike Put below we see a pretty health order book. The bid-ask spread of 0.

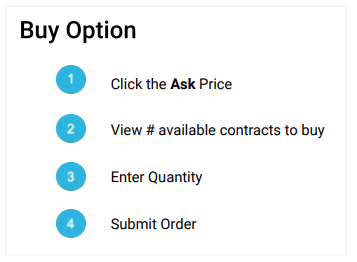

You should have no problem selling your position without slippage. You are a Market-Maker if you enter the trade with a Limit order. You are a Market-Taker if you enter the trade with a Market order, accepting a Limit order that already sits in the Order book. Although there is no fee advantage in being the Maker, it is good practice to enter and exit Bitcoin Options trades with Limit orders nevertheless as by definition you get a better price than trading at market.

Skew : an excellent Bitcoin options resource. Deribit Options Cheat Sheet. This contains a couple of mistakes which I flagged to Deribit but they are too lazy to fix. BambouClub BambouClub. Tweet This. There are three places to check volatility: The Deribit platform Skew. Fees for Maker and Taker are the same optoons 0.

Bitcoin Pptions Deribit Cryptocurrency Trading. Continue the discussion. Bitcoin Has Cashflow: Lending Bitcoin. Hackernoon Newsletter curates great stories by real tech professionals Get solid gold sent to your inbox.

Every week! Alex Wang Mar What happens 5 minutes before and after funding time on Bitmex? Diego Karasik Apr Anthony Xie. Michael Usiagwu. Contact Us Privacy Terms.

Options Trading: Understanding Option Prices

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Fixed USD and Volatility orders can be changed by pricing engine maximum once every 6 seconds, because Deribit index updates every 6 seconds. However, since these are charged on underlying asset value, rather than your profit, these fees can consume a significant chunk of your profits. Volatility orders are yet a more advanced type of order, where the implied volatility of the order will remain how to buy call options on bitcoin. Unlike standard spot trading exchanges, Bitcoin options exchanges tend to suffer from low daily trade volume and poor liquidity. For its options, LedgerX allows its users to buy options with a range of strike prices and expiry dates, with both call and put options available. Related Terms Bitcoin Definition Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. In addition, since options contracts are typically low cost, relative to the how to buy call options on bitcoin asset price, they remain one of the most cost-effective ways of hedging against your existing investments. After buying a put option, the more BTC goes down before expiry, the more your option is worth. This works because options allow you to profit on changes in the underlying asset value, rather than the cost of your position. With Bitcoin binary options, this is reduced to a simple prediction whether Bitcoin will fall to a lower value than its current price. When investing in Bitcoin options, investors pay a premium for the chance to buy or sell Bitcoin at a set price in future, essentially providing a clever way to long or short BTC, giving owners an opportunity to make gains in a declining market, and multiply their profits in a bull market. Login Newsletters.

Comments

Post a Comment